Why choose to invest in a Spousal RRSP?

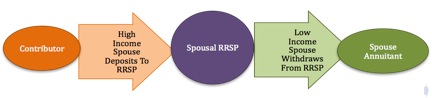

A Spousal RRSP is one in which the contributor and annuitant are not the same individual. Typically the spouse with the higher annual income, or potential higher pension income in retirement, will set up a Spousal RRSP for the spouse with the lower income. The following flowchart illustrates this type of investment process:

The Spousal RRSP enables the higher income-earning spouse to contribute to an RRSP, claim the contribution credit on their income tax return, and have the contributions and accumulated RRSP income paid to their spouse at a future date. The Spousal RRSP enables one spouse to split their retirement income with their spouse.

Related Questions

- Who qualifies as a spouse?

- How much can I contribute to a Spousal RRSP?

- Who can contribute to a Spousal RRSP?

- How are withdrawals from a Spousal RRSP taxed?

- When would a withdrawal from a Spousal RRSP be taxed in the spouse annuitant’s hands?

- What if an Individual and Spousal RRSPs are merged into a single RRSP account?

- Can previously merged Individual and Spousal RRSPs be separated into their original RRSP accounts?

- What if I am older than 71 years of age, can I still contribute to a Spousal RRSP?

- Are there any special fees for a Spousal RRSP?

- If at the date of my death I have unused contribution room available, can the legal representative for my estate still make an RRSP contribution?

- Who receives the income tax information slips associated with a Spousal RRSP?