Does inflation have an impact on bond pricing?

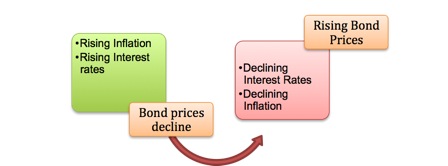

Changes in the rate of inflation and changes in current interest rates are closely connected. As the rate of inflation rises, investors demand a higher coupon rate or yield on the bonds they invest in. Therefore, if the expectation is for future levels of inflation to rise, then this will motivate investors to demand higher returns from their bonds. As a result, interest rates will rise when investors expect inflation to increase. As discussed previously, if inflation expectations increase, interest rates will rise and the market prices for existing bonds will decline.

Conversely, if investor expectations for inflation remain low, they will be willing to accept a lower return from their bond investments and interest rates will decline. Because inflation expectations remain low and interest rates decline, the market prices for existing bonds will rise.

Related Questions

- What are some common features associated with bonds?

- What are some terms associated with bonds?

- How does the bond market work?

- How are bonds priced?

- Where can I go to get up-to-date trading information for bonds?

- How do interest rates influence a bond’s market price?

- Do bond maturity dates influence pricing?

- Do credit and default risks impact bond prices?

- What are the definitions of the corporate credit ratings from the DBRS?

- What is the DBRS rating philosophy?

- What is bond liquidity?

- What does it mean to purchase a bond at a premium?

- What does it mean to purchase a bond at a discount?

- What is accrued interest income?