Registered Education Savings Plan (RESP)

Many parents and grandparents dream of having their children or grandchildren further their education after high school. But they also understand that rising post-secondary education costs and a shortage of well paying student jobs make it difficult for young students to finance post-secondary education on their own. To help families and individuals save for their future post-secondary education costs, the federal government created a special registered savings account – a Registered Education Savings Plan (RESP).

For most people the motivation for opening an RESP is to obtain the government grants money and to shelter any accumulated investment income earned within the RESP account from income tax, until the funds are withdrawn.

Example: If you were to open an RESP account and make annual contributions of $2,500.00 and applications for the maximum government grants each year for the first 18 years, you will have contributed approximately $45,000.00, received $7,200.00 from the government, and your child’s RESP would be worth approximately $66,949.00. What an amazing accomplishment. You could provide your son or daughter their choice of educational experiences.

The government grants are an amazing benefit. Think about it. Where else can you get paid $500.00 for every $2,500.00 that you save? Where else can you receive effectively a 20% return on your savings, every year, guaranteed by the federal government? By starting early, contributing every year, and collecting the government grants, you can help fulfill your son or daughter’s educational and professional dreams.

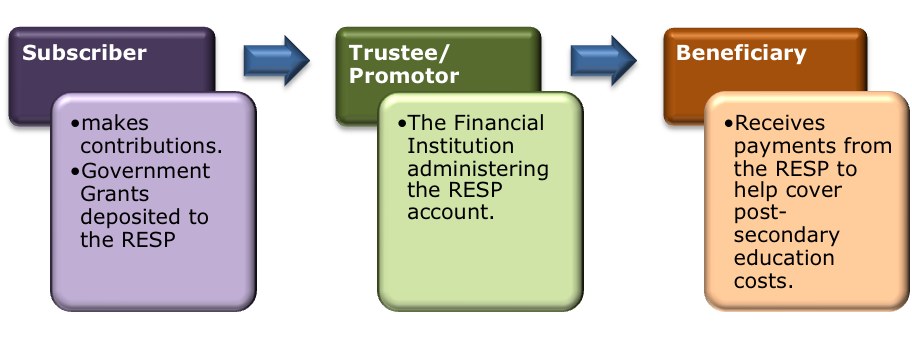

In general, an RESP is a type of trust account registered with the Canada Revenue Agency (CRA) that assists with the accumulation of savings for a child’s education costs after high school. As with all formal trust accounts, an RESP account has

- a subscriber (the contributor of the funds to the RESP)

- a promoter/provider (the financial institution that administers the RESP account)

- a beneficiary (the intended student)

Process of opening an RESP

You can open an RESP account through any credit union, chartered bank, mutual fund company, insurance company, full service and discount brokerage firm, or scholarship plan dealer. Opening the RESP itself is a fairly straightforward process involving the following three easy steps:

- In general, a subscriber opens an RESP account with an approved RESP promoter (usually the subscriber’s financial institution). First, the subscriber will select one of three RESP plan types (Family, Individual, or Group) and identify the plan’s intended beneficiaries.

- Next the subscriber makes annual contributions to the RESP account and asks the account’s promoter to apply for a special government education grant called the Canadian Education Savings Grant (CESG).

- Upon receipt and approval of the CESG grant application, the government will make a deposit of the grant into the RESP account.

The RESP will then sit and build on its investment until the student or beneficiary is ready to receive payment, or until the plan matures.

Note: You will need a social insurance number (SIN) for each beneficiary and subscriber in order to open an RESP account. If the intended RESP beneficiary does not yet have a Canadian SIN, you can obtain the application details by visiting the Canadian government link: Service Canada

The following figure illustrates the process outlined above to opening an RESP account: