Annual Fee Accounts

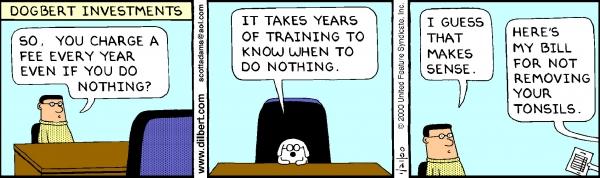

An annual fee account is a fee for service type of account. Some investors choose this type of investment option as opposed to paying individual costs per purchase. This allows you to know what your annual investment costs will be from the outset.

What is the cost to purchase an annual fee account?

The fee is calculated as a percentage of the account’s current market value and deducted from the account on a quarterly basis.

Each financial institution has its own fee schedule. The annual percentage can be influenced by the value of the account, the types of investments held in the account, and the percentage invested in bonds and Guaranteed Investment Certificates (GICs).

The set percentage is charged on all assets held in the account. This includes cash balances, common shares, mutual funds, Exchange Traded Funds, preferred shares, bonds, GICs, etc.

With fee type of accounts, you are usually given a limited number of free transactions per year. If the transactions within the account exceed the allowable number of free transactions, you will then pay traditional transaction costs for each additional trade.

The number of free transactions is a function of the account’s current market value. Typically, the larger the account value, the lower the annual percentage fee and the greater the number of free annual transactions.

Typically, you need to understand that fee accounts are better suited for investments that are dominated in the stock market. If an account is invested in bonds, GICs and preferred shares, then you may be better advised not to have a fee for service account. If a bond earns 4.0% per year, in interest income, it can be difficult to justify paying 1.50% – 2.25% in annual fees.