Mental Framework and Investment Decisions

Mental framework is a major area of study in Behavioural Finance. It refers to how individuals receive and process information. Each of us has mental frames that we rely upon to receive and filter information and to help us make decisions. Our mental frame enables us to take short cuts when making individual decisions.

Studies show that your mental frames will have been developed over time and are often shaped by social, cultural and environmental influences. As a result of our frameworks, individuals can have the same experience but arrive at opposite conclusions.

Examples

Example: Imagine a friend rapidly closes and opens an eye. You will respond very differently if you attribute the action to a physical framework (they blinked) or an emotional/social framework (they winked). Even if your friend’s actions were the result of dust in their eye, your mental frame will determine whether the action was involuntary or it held social significance. Further, if you concluded the action was a wink, your mental frame will help you to categorize the action as emotionally meaningful or not: the wink may be a sign of affection or simply reinforcing humour between friends.

So how does your mental framework influence your investment decisions? Well, simply, your mental framing will influence the decisions you make concerning your finances and your investments. In particular, psychologists Daniel Kahneman and Amos Tversky have demonstrated that framing could affect the choices you make. Simply by altering how a question or problem is presented will influence your decision. In their 1981 study, they demonstrated that when the same problem is presented in differing ways the same individual would arrive at different decisions.

Example: If an investment currently trades at $10.00 and its future price 12 months from now is unknown but thought to possibly be somewhere between $15.00 and $5.00, how this opportunity is presented to an investor will influence their decision. If the investment were recommended to you and the report forecasts a 12-month target price of $5.00, would you buy it? What if the report showed a 12-month target price of $15.00, would you buy it? Both are potential outcomes, but how the recommendation is positioned will determine whether or not you will buy the investment. Your decision would depend upon your mental framework. Are you trying to buy investments that go up or are you looking to short investments that go down.

The investment, news reporting, and marketing industries understand exactly how important your mental framework is to the decisions that you make. Just as important as it is for you to understand that your mental framework influences your decisions, you should also be aware that what you readhas also been scripted to take advantage of your mental framework.

Remember: Our mental frameworks influence how we receive and analyze information, as well as how we communicate with others. Our framework enables us to take shortcuts in arriving at decisions and can often result in inaccurate conclusions.

A few possible effects of mental frameworks on our decision-making processes are described below:

- Consensus effect

- Overconfidence effect

- Hindsight bias

- Narrow framing

Consensus effect

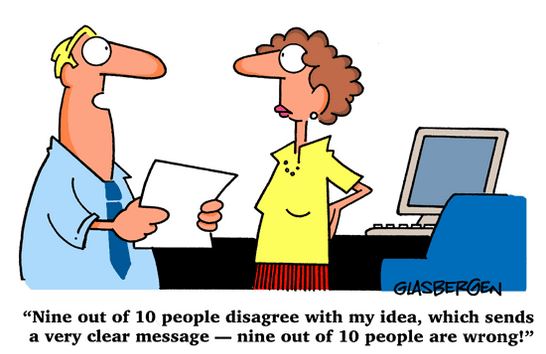

This is the tendency for each of us to assume that our personal mental frameworks are the same as for others. Our beliefs, preferences, values and habits are thought to be normal, the same as everyone else. This framework tends to lead us to believe that our decisions and conclusions are the same as any other sane person. This belief in a consensus that does not exist can lead to an increase in our self-confidence and an overestimation of our cognitive abilities. This in turn can lead to additional biases.

When combined with Sampling Bias and Overconfidence effect, the Consensus effect can cause individuals to stubbornly refuse to alter their decisions when they are confronted with contradictory evidence. Often those who do not agree with their investment decisions are thought to be inferior in some way. This stubbornness is common for investors that have done their research and bought an investment only to watch the investment decline in value. Very rarely do they accept that their decision to purchase was incorrect.

Overconfidence effect

The majority of us suffer from overconfidence in varying degrees. Overconfidence can be a factor in the simplest of decisions like trying to skateboard at the age of 50 or more complicated decisions like tackling that bathroom renovation with little or no experience. After all, how hard can it be? Our overconfidence is further supported by two additional influences: our optimism and our superiority.

Studies have shown that we tend to be overly optimistic about future outcomes. Our optimism causes us to overestimate the likelihood of positive events and underestimate the probability of negative events.

Example: When certain groups were asked to estimate the outcome of certain events, they consistently overestimated positive outcomes and underestimated negative outcomes, for example:

- Almost all newlyweds in a U.S. study expected their marriages to last a lifetime, even while aware of the divorce statistics.

- Professional financial analysts consistently overestimate corporate earnings.

- Most smokers believe they are less likely to develop smoking related illnesses than other smokers.

- Underdog sports teams and athletes are consistently overly optimistic about their abilities to win against a superior opponent.

- Married men consistently rate their sense of humor as above average, which is contrary to how their spouses rate their sense of humour.

These instances of overconfidence are heavily influenced by our inherent optimism and superior view of our abilities.

Our belief in our superiority also supports our overconfidence. People tend to overestimate their positive qualities and underestimate their negative qualities, relative to others. For example, take a look at these studies:

- The College Board in the United States conducted one of the first studies of illusory superiority in 1976. The study asked approximately one million students sitting the S.A.T. exams to rate their abilities when compared the other students. In the area of leadership ability, 70% of the students ranked themselves as above average.

- In a survey of U.S. students, participants were asked to compare their driving safety and skill to the other participants in the study. For diving skills, 93% ranked themselves as above average and 88% ranked themselves as above average for safety.

- In a survey of faculty at the University of Nebraska, 68% rated themselves in the top 25% for teaching ability.

- In a similar survey of MBA students attending Stanford University, 87% ranked their academic performance as above average.

Remember: Investors and investment professionals are susceptible to overconfidence, optimism, and beliefs of superior abilities. These influences can create errors in the analysis of an investment’s potential.

Hindsight bias

Hindsight bias is a human condition that exists where we believe that if an event occurs, it should have been predictable and if a predicted event does not happen, then it was unpredictable.

Have you ever wondered why it is that events can be explained so logically after they occur, but never before? The reasons for the stock market’s moves are always crystal clear after the fact: we say Oil moved higher because…, or The stock index fell because…, etc.

Hindsight bias also can influence our recollection of past events and their causes, leading us to reconstruct a set of cause and affect chains that lead to an erroneous theory for predicting similar future events. With the aid of hindsight, we create patterns and relationships leading up to the event that may not exist.

Example: As the following old joke about Penguin Logic demonstrates, using hindsight to recreate a chain of events can lead us to incorrectly build relationships that do not exist:

Remember: Investment recommendations and decisions are often made based upon research that relies upon hindsight analysis.

Example: Often the marketing literature that accompanies brand new investment products, Principal Protected Notes (PPNs), and Exchange Traded Funds (ETFs), will utilize back-tested data as a basis for the investment recommendation. Back-testing is simply another form of Hindsight analysis. Back-testing can be used to support any investment recommendation. It is the same as saying, “If an investor had bought shares of Google at $85.00, their investment would have increased by over 600%, therefore, they should buy Google shares today!”

Hindsight bias also benefits from additional complimentary biases such as Survivorship bias and Narrow framing.

Note: Survivorship bias will be discussed further in our section Bias. In our Google example, Survivorship bias distorts the analysis and recommendation because it only uses the successful, surviving example as its basis. By excluding all of Google’s failed competitors, the analysis eliminates most risk factors from the analysis and conclusion. Survivorship bias is not just a serious flaw in investment research, but also in many sets of economic and business data.

Narrow framing

Another serious flaw in many investment research reports and analysis involving mental framework is Narrow framing. In this world of information overload, how does an investor avoid becoming confused and lose focus? Simply, we reduce or narrow the area of our focus.

By narrowing our field of reference, our research efforts can be concentrated and focused on a smaller set of data variables, making our investment research efforts manageable. In so doing unfortunately we often ignore the bigger picture. Or as the old saying goes, “We cannot see the forest for the trees.”

A narrow framework reduces the number of influences and minimizes the number of relationships that are examined. It simplifies our analysis and decisions.

Investment analysis and research often bases an investment recommendation and decision on a managed, narrow framework. By doing so it enables the writer to convey the concluding recommendation with as few moving parts as possible. This narrow framework helps the reader to follow the smaller number of relationships to the same conclusion as the writer. By narrowing the framework, a writer often eliminates complicated, confusing and maybe even opposing relationships from the discussion and conclusion. This narrower framework can often lead to erroneous cause and affect relationships as the basis of the analysis.

Note: Individual savers and investors are also susceptible to narrow frameworks.

Example: When we look at the savings habits of most Canadians, we find that most break up and compartmentalize their savings into smaller frames. For example, we save for our child’s future education and simultaneously borrow to buy a car. We might invest windfall money in riskier options, while at the same time we invest savings earmarked for retirement for safety. Rather than look at our family’s bigger picture, when it comes to saving and investing, we prefer to deal with each objective within a more narrowly focused individual framework.

Note: Most investors also use narrow framing when making investment decisions, preferring to make investment decisions for each of our RRSP, TFSA and taxable accounts independently from each other. This narrow framework may actually create elevated investment risks and conflicting investment decisions.