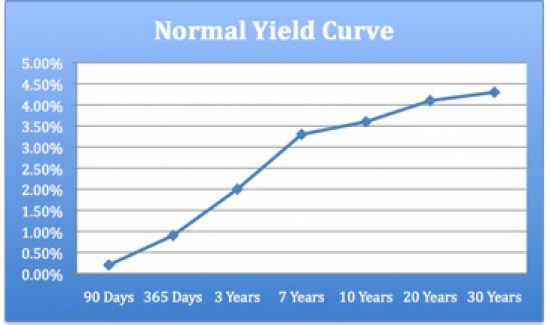

A normal yield curve is one that slopes from the lower left corner to the upper right corner. This shape describes a bond market where short-term interest rates are lower than those for bonds of longer-term maturities.

A normal yield curve is thought to represent an economy that is healthy. The economy is growing, unemployment remains low, asset prices are rising and consumers expect a positive rate of inflation. As a result, a normal shaped yield curve expresses the bond market’s need for a bond return (interest rate) to increase as the length of time to maturity for bonds increases. The bond investor feels the healthy economy will support a positive inflation rate into the foreseeable future and, as a result, they demand a higher interest rate return to compensate them for the inflation risk.

Because the normal yield curve is thought to represent a healthy current and future economy, investors transfer this outlook to the stock market, thereby reinforcing their confidence that share prices will benefit.

Some investors that rely upon the predictive powers of the yield curve have fine-tuned their analysis to include studying the steepness of the curve. They believe that a steep slope is indicative of a rapidly expansion or a period when an economy is moving out of a recession.