Retirement Planning: Overview

Most Canadians dream of reaching their retirement date with sufficient savings and income to support a secure and leisurely retirement. They dream of a retirement filled with trips to long dreamed of foreign destinations, long hours pursuing their passions and hobbies, volunteering hours for their favourite causes, spending time with family and friends, and enjoying the freedom to do anything they desire.

And for most Canadians, if a financially secure retirement were their only savings obligation, achieving their dream would be simple. Unfortunately life is rarely simple and the many financial responsibilities life presents often complicates and obstructs our ability to focus all of our savings on achieving our dream retirement lifestyle.

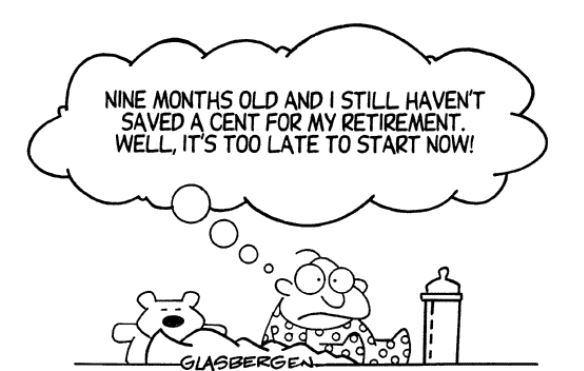

For this reason Canadians are advised to start saving for their retirement as early as possible and our governments provide incentives in the form of income-tax sheltered accounts and income-tax deductions for contributions made toward our retirement. And for a few Canadians, planning for their retirement has been a life-long pursuit. These few individuals became devoted disciples to the investment industry mantra that tells us that we must begin saving and investing as early as possible if we are going to accumulate the million-dollars-plus needed to finance our retirement.

Note: The majority of Canadians do not retire with a million dollars or more in accumulated savings. Despite this fact, we are consistently told this is the amount we need. Unfortunately for over 30 years, inflation and interest rates have consistently declined causing the dollar amount we are told to accumulate and the number of exotic investment options available to increase dramatically, adding additional pressure to our household finances and our investment decisions. For example, if you need $50,000 of investment income to support your retirement and you invest in 5-year Government of Canada bonds, ten years ago when the bond yield was 5.35%, you would have been told that you would need savings of $934,579.43. Today with the bond yield at 2.19%, you would need $2,283,105.00 to generate that same $50,000 of investment income. No wonder you might feel like you have been battling uphill when it comes to saving for your retirement!

Life’s other pressures

Starting early to save for retirement is important because it helps us to establish goals and to develop a savings discipline, but if we focus too much and too early on accumulating a million dollar plus for our retirement, we will be adding undue pressure on our finances and our ability to enjoy many opportunities that arise on the way to retirement. Ultimately retirement is only one of life’s milestones, not the only one. For many Canadians there are numerous milestones that they experience between their early twenties and their ultimate retirement date. Some may be

- finishing and paying for their education

- buying their first car

- starting their career

- finding a soul-mate and getting married

- saving for and buying their first home

- having children

- buying a second car

- saving for their children’s’ education

- paying off their mortgage

- saving for and buying a vacation property

- saving for vacations overseas

- helping to pay for children’s education

- saving for children’s weddings

In addition to the above list, there are also many unplanned and unwelcome milestones that complicate our retirement planning, including events such as these:

- health problems

- losing our job

- surviving a divorce

- surviving a devastating investment or business loss

- surviving the deaths of a family member or friend

Warning: retirement plans can change!

Another retirement planning reality we need to be aware of is the fact that often the vision we have of retirement, when we are in our twenties, will evolve into something completely different by the time we reach our mid-fifties. This shift in our retirement dream is the result of a number of factors. First, the vision of retirement in our twenties simply focuses a dollar amount for our savings and the investment income it can generate. We don’t think about income from private and government pensions and we don’t think about supplementing our retirement income by using a portion of our saved capital. In our twenties we have no idea what our lifestyle will be like when we reach retirement.

For example, when planning your retirement you cannot possibly know the answer to these important factors when you are in your twenties:

- Will you be married or single?

- Will you have been wildly successful in your career or did you have to work hard simply to maintain a simple lifestyle?

- Did your employer have a great pension plan (Defined Benefit or Defined Contribution)?

- Were your savings invested successfully while you worked?

- Are you healthy?

- Do you love to travel or are you happiest in your garden?

- Do you enjoy sailing on your boat, traveling and playing at different golf courses, or is your hobby working in your wood working shop?

- Will you receive an inheritance?

A person in his/her twenties often pictures a wonderful, healthy and financially rich retirement. They often do not think of all the possible hiccups along the way that might alter or impede the achievement of their retirement vision. However, once a person reaches their mid-fifties, their lifestyle is well established, the origins of their happiness have been identified and they know the sources of their expenses and available income, as they approach their retirement.

When should you establish a retirement plan? Begin early with saving (the formal planning comes later)

Before spending any time on a formal retirement plan, Canadians should first establish a savings discipline and they should begin saving for their retirement in small amounts. Establishing a savings discipline while you are in your twenties or thirties is more important than having a formal retirement plan. Saving small amounts early will help to create retirement savings for your future without crippling your ability to pay your current expenses and to enjoy life today.

One of the difficulties in establishing a formal retirement plan when you’re in your twenties or thirties is that your retirement plan becomes less certain and is of less value the further you are away from your retirement date. For example, if you’re thirty years old and you plan to retire in twenty-five years, you’ll be required to make a number of big assumptions and predictions in order to answer the following retirement planning questions:

- Will you work at the same job and same company for the next 25 years?

- Will your area of employment expand over the next 25 years or will it disappear?

- Will you still be married or will you marry in the next 25 years?

- Will you be healthy and injury free over the next 25 years? Will your partner?

- Will your children need additional help paying for their education?

- Will you need to help take care of aging parents or dependent family members in the next 25 years?

- Will you maintain the same regular retirement savings contributions for the next 25 years?

- On average in the next 25 years, you will experience at least five or six new business cycles – boom and bust, what rate of return do you assume for your savings and investments?

- What will the rate of inflation be over the next 25 years?

- What rate of return will Guaranteed Investment Certificates (GIC), bonds, and stocks pay over the next 25 years?

- What will your other assets – business, home, cottage, etc. be worth in 25 years?

- What will your living expenses be in retirement, 25 years from today?

Unless you are really into creating financial plans, you probably do not need to establish a retirement plan until you are five or seven years away from your chosen retirement date.

Note: Although the accuracy and value of a retirement plan diminishes as the length of time to the retirement date increases, the opposite can be said about saving for your retirement. Saving for your retirement should be treated as a long-term, regular expense within your household budget and setting aside small, regular amounts will actually enhance your success going into retirement.

Formalizing your retirement plan in the latter years

Most Canadians should begin thinking about their retirement plan within approximately ten years of their actual retirement date and they should begin to make a formal retirement plan approximately five years from their date of retirement.

A formal retirement plan requires crunching real numbers. Your numbers and financial assumptions need to be as close to your actual retirement numbers as possible. When you are approximately five years away from your retirement date it will be easier to identify the following criteria and make accurate financial assumptions for the completion of your retirement plan. (As a result, the accuracy and value of your retirement plan increases considerably.) Try to accurately estimate the following financial influences:

- your retirement lifestyle

- your monthly and annual expenses in retirement

- your accumulated savings available to support your retirement

- your monthly pension income (private and government)

- your expected investment rate of return (GICs, bonds, stocks, real estate, etc.)

- the rate of inflation

This will help you get started planning for your retirement.

Note: Within our retirement planning section you will find the tools and resources needed to complete, monitor and manage your retirement plan. Within the InvestingForMe Tools section you will find the following calculators to help you make projections for the retirement values of your savings, investments, retirement income and expenses:

- Household Budget

- Net Worth Statement

- Retirement Budget Estimator

- Retirement Net Worth Statement

- Retirement Planning Calculator

- RRIF Payment Planning Calculator

- Income Tax Estimator

- Projected Annual Portfolio Value Comparison

- Taxable vs. Tax Advantaged Investments

- Mortgage Payoff Comparison

- plus more