Mutual Funds and Segregated Funds

According to the Globe and Mail’s mutual fund website, as of October 2016, there were over 29,208 mutual funds and segregated funds (up from 19,740 in May 2014 and 17,047 in February 2013) available in Canada. That’s a lot of choices!

With so many funds to choose from you can be afford to be a little picky when selecting where to put your savings. One of your top priorities should be to find funds with the lowest costs so that you can keep more of your savings invested and working toward your goals.

When thinking about investing in mutual funds and segregated funds, you need to look at the costs associated with them, including things like:

- the annual investment cost, or management expense ratio (MER)

- buying and selling costs

Annual investment costs (or MER): What is a MER?

All mutual funds and segregated funds charge a management fee and incur expenses, which the fund companies combine to calculate the fund’s management expense ratio (MER). The MER is the annual investment cost you pay to the fund management company. Many investors, however, don’t even realize they’re paying these fees. Why?

Typically, you will never see a charge for the MER expenses. There will not be any entries in your account statement and no invoice issued. This is because the MER expenses are deducted by the fund’s management company before they calculate the Net Asset Value(NAV) of your units. So if your account statement says that you own 100 units of XYZ fund and the units are worth $10.00 each, the $10.00 number has been calculated after the fund company has deducted their management fees and operating expenses. So you will typically never see a debit, deduction, or charge for these costs in your account statement.

Remember: You should understand the cost of the MER for each fund you own!

How do you calculate the MER?

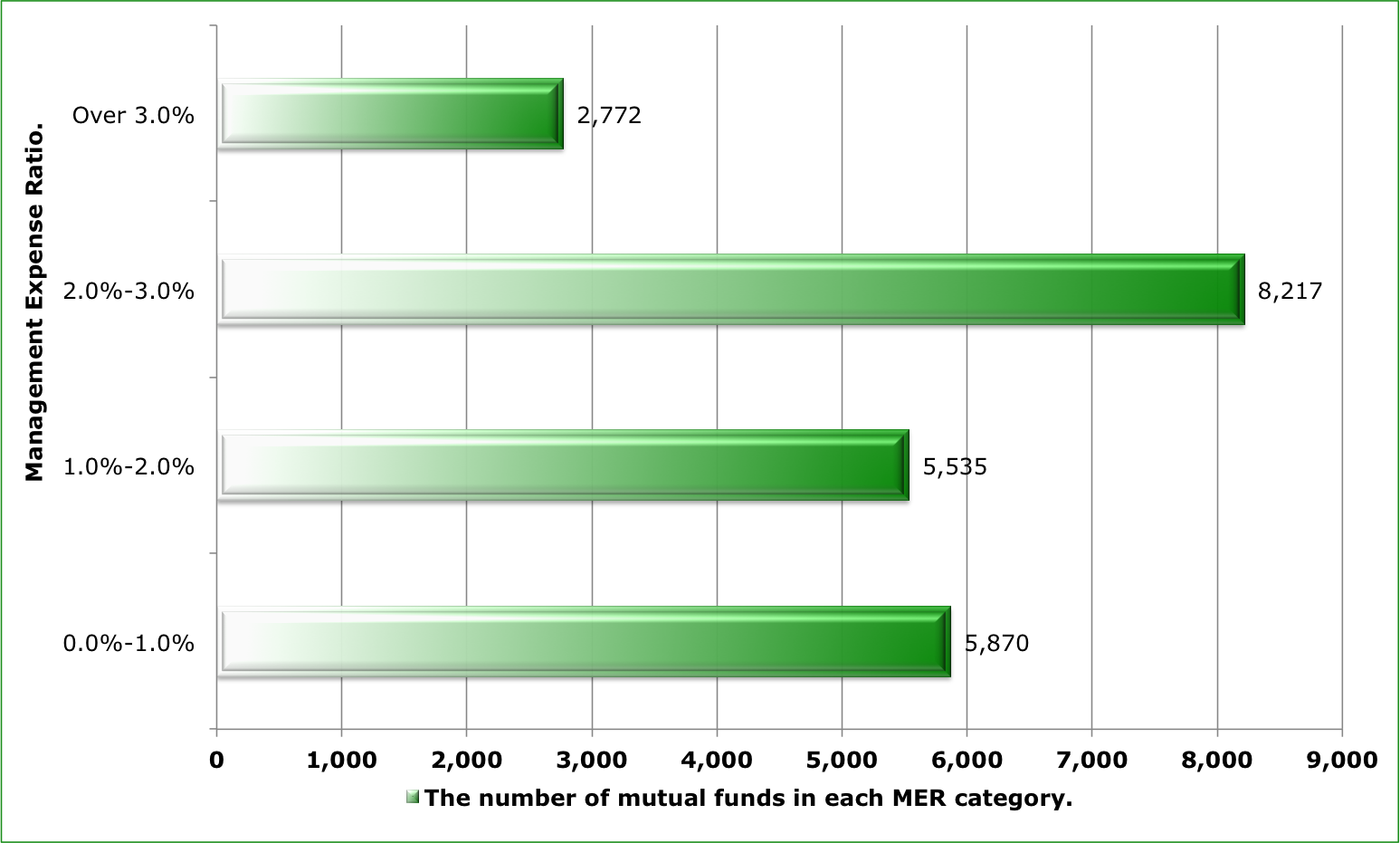

In Canada, approximately 50% of all mutual funds and segregated funds have annual investment costs of 2.0% or higher. The MER is calculated by adding up all of the annual expenses (Management Fees, advertising, brokerage fees, Trailer Fees, etc.) incurred by the fund manager and then dividing the total expenses by the fund’s total current market value.

Example: Let’s say you invest in a $2 million mutual fund that incurred the following expenses in a single year:

| Management Fees | $30,000.00 |

| Marketing Expenses | $10,000.00 |

| Trailer-Service Fees | $10,000.00 |

| Trading Expenses | $5,000.00 |

| General Expenses | $3,000.00 |

| Total Expenses: | $58,000.00 |

To calculate the MER in this example, the total expenses ($58,000) are divided by the fund’s current market value ($2,000,000). Thus the MER in our example is 2.90%, annually. Therefore, if you invested $10,000 into this fund, your annual investment costs would be $290.00. If you invested $200,000 in funds with a similar MER, then your annual investment expense would be $5,800.00, or $483.33 each month.

Note: Below is a chart that summarizes the more than 22,394 mutual funds in Canada by their MER percentage. The majority of mutual funds have a MER cost between 2-3%.

Are there additional costs when buying or selling mutual funds and segregated funds?

Yes, if the fund you purchase is anything other than a no-load fund, you may have to pay fees when you purchase or sell the fund. The additional cost may be the result of the mutual fund or segregated fund company paying your advisor and their financial institution a commission to purchase, a trailer-service fee, or a combination of both. The commission paid to the financial institution and your advisor is in addition to the ongoing MER expenses (as outlined above).

Do different types of funds incur different types of purchase/sales costs?

Yes, purchase commissions can take on different structures when it comes to buying and selling mutual funds and segregated funds, including the following:

- no-load funds (funds with no purchase or sales commission)

- front-end funds (funds with a commission cost at the time of purchase)

- back-end load funds (funds with a Deferred Sales Charge (DSC)). A DSC enables you to purchase a mutual fund without incurring a commission cost at the time of purchase. Instead, you pay the sales charge at the time the fund is sold. The actual sales charge paid is directly linked to the length of time you have held the fund investment.

- low-load funds (funds with a smaller up front sales commission and a shorter deferred sales commission schedule). See the Low-load redemption schedule table below.

Remember: The cost to purchase or sell the fund investment is controlled by the financial firm or their representative. They have full flexibility to charge you any amount (typically between 0% and 5%). In other words, know your investment costs.

Note: For funds purchased with a DSC structure, even though you do not pay a fee, unless you sell the fund before the redemption schedule expires, your advisor and their financial institution receives a commission from the fund company on the day you purchased the fund. The DSC you pay simply reimburses the fund company for a portion of the commission previously paid to your advisor on the day you purchased the fund.

How do you calculate your cost when selling your mutual and segregated funds when they have a Deferred Sales Charge (DSC)?

Most funds that are sold with DSCs have DCS fees that are based upon a five or seven-year redemption schedule (i.e. length of time before you can cash out with a 0.0% DSC fee). For example, if a fund is held for one year in a 5-year redemption schedule, and then sold, you may have to pay a 5.5% service charge or commission (DSC) to the fund company. This can be a very onerous cost.

The chart below is an example of a back-end load or DSC fee schedule. (Note how with a DSC investment you want to own it for the long-term so that you don’t incur substantial investment costs!)

| DSC Redemption Schedule | |

| During first year | 5.5% |

| During second year | 5.0% |

| During third year | 4.5% |

| During fourth year | 4.0% |

| During fifth year | 3.5% |

| During sixth year | 1.5% |

| After six years of ownership | 0.0% |

Some fund companies also offer low-load options. In this case you pay a smaller up front sales commission subject to a shorter DSC schedule as outlined in the table below:

| Low-load Redemption Schedule | |

| During first year | 3.0% |

| During second year | 2.5% |

| During third year | 2.0% |

| After three years of ownership | 0.0% |

What is a trailer-service fee?

Before you can make an informed investment decision you should understand how the financial institutions and their representatives are paid. They are paid trailer-service fees that are part of your MER expense. The trailer-service fees vary depending on the type of fund you buy and the fee is an annual expense as outlined below:

- If you purchase a no-load, front-load, or low-load fund, the financial institution that sold you the fund may receive a quarterly trailer-service fee from the fund company during the time you continue to hold the fund investment. The institution will then pay a portion of the trailer-service fee to your advisor.

- If you purchase a DSC or back-end load fund, then the financial institution and your advisor will receive a smaller or no trailer-service fee. The trailer fee is reduced because under the DSC structure your financial institution and advisor has already received a commission on the day you purchased the fund.

- If you were to buy a Series F fund the mutual fund company would not pay a trailer-service fee. Most mutual fund companies offer individual funds classified as Series F. These are funds that pay no trailer-service fees and, as a result, have lower MERs than their same funds that pay the trailer-service fee. They are designed for investors wishing to hold mutual funds within an account that pay the financial institution that administers your account an annual fee.

Note: For more information regarding these types of funds, see our sections Class Room – Investment Type: Mutual Funds/ Segregated Funds.