Mortgage-Backed Securities (MBS)

Mortgage-backed securities (MBS), also known as MBS Bonds, are a type of bonds that is secured by a pool of mortgage loans. Individual mortgages are pooled together and used as collateral to issue mortgage-backed securities, which are then sold to investors.

The investor as bondholder receives monthly payments (usually on the 15th of each month) that include both mortgage principal and interest. The key difference between an MBS and a regular bond (which typically pays interest every six months), is that the MBS monthly payments include a portion of principal.

Mortgage-backed securities are typically secured by mortgages that qualify under the National Housing Act (NHA). There are four different categories of National Housing Act (NHA) MBS pools available to investors in Canada:

- exclusively individual homeowner mortgages

- multi-family mortgages

- social housing mortgages

- mixed (a combination of any of the above)

In Canada, there are two types of MBS bonds available to investors.

- pre-payable mortgage pools are a collection of mortgages that permit the borrower the right to make early principal payments under certain conditions, which means that MBS investors may receive unscheduled payments of principal and, in some cases, a portion of any applicable prepayment penalty paid by the borrower.

- non-pre-payable mortgage pools do not permit unscheduled early principal payments. The MBS investor’s monthly payment will consist of a principal portion and an interest component. Therefore, monthly cash flow is predictable and consistent. At maturity, any principal that has not been repaid over the life of the MBS pool is then returned to the investor.

In Canada, NHA mortgage-backed securities are pools of Canada Mortgage and Housing Corporation (CMHC) insured residential mortgages. CMHC is a federal government Crown corporation created in 1945 under the NHA. As a result, a MBS bond have investment qualities that are inherent in both real estate mortgages and regular bonds.

In the event that a mortgage holder does not make their regular payment, as required by the terms of their respective mortgage agreement, the MBS Trust must still make the scheduled payment for credit to the MBS investors. CMHC mortgage insurance protects the MBS Trust and the NBS bond investor against mortgage default, assuring payment of principal and interest in accordance with the terms of the mortgage insurance policy.

Note: From a credit quality perspective, NHA mortgage-backed securities are considered to be “AAA” instruments, like Government of Canada Bonds.

Market pricing of MBSs

Just like conventional bonds, mortgage-backed securities (MBSs) can be held to their maturity date or sold prior to their maturity in a secondary market. The Canadian financial industry has established a secondary market where MBS are traded. Just like conventional bonds, MBS prices tend to fluctuate with changing interest rates.

If sold prior to the maturity date, the MBS pricing will be adjusted for the amount of principal that has already been prepaid. To help determine the buying and selling prices, the Central Payor and Transfer Agent provides an eight decimal number that states the proportion of principal still to be repaid by the mortgage pool. This is reported monthly for each NHA MBS pool.

Example: Let’s assume an investor desires to sell $10,000 Face Value of a 9.0% NHA mortgage-back security, where $45.01 of principal has been repaid, to date, and there is no accrued interest owing. This $10,000 block of MBS is sold at $100.00, which is determined on the secondary market.

Proceeds to the investor = (Original face value X RPB factor X selling price/100 + accrued interest)

The RPB factor reported is 0.9954990.

Thus, Proceeds to the investor = ($10,000 X 0.9954990) X $100.00/100+ $0.00 = $9,954.99

If the selling price was $101.85, then the sale proceeds would be $10,139.16.

Tax considerations

As stated, the MBS monthly payments are a combination of interest income and return of principal. As outlined in the CMHC MBS Information Circulars, Canadian residents are taxed as income on the payments’ interest portion. If capital gains/losses are realized at disposition or maturity of the MBS bond, these will be taxed under normal capital gains income tax rules.

Monthly MBS payments

There is a formula for calculating the NHA MBS bond payments to investors. The interest rate is compounded semi-annually (not in advance) and is applied to the outstanding principal balance at the end of the previous month. This is the same method used to calculate interest on all NHA-insured mortgages.

The monthly payment is calculated by adding the following:

- stated interest payment (based upon the coupon rate of the issue),

- scheduled principal payment,

- additional principal for partial repayments (if made) and,

- repayment penalties (if applicable)

The sum of these payments is the total monthly payment.

MBS payment at maturity

At maturity, the investor will receive the final payment of the remaining unpaid principal typically 15 days after the maturity date of the NHA MBS. It is important to understand that if you hold the MBS certificate, the final payment of principal shall be remitted only upon the surrender of the outstanding MBS certificate.

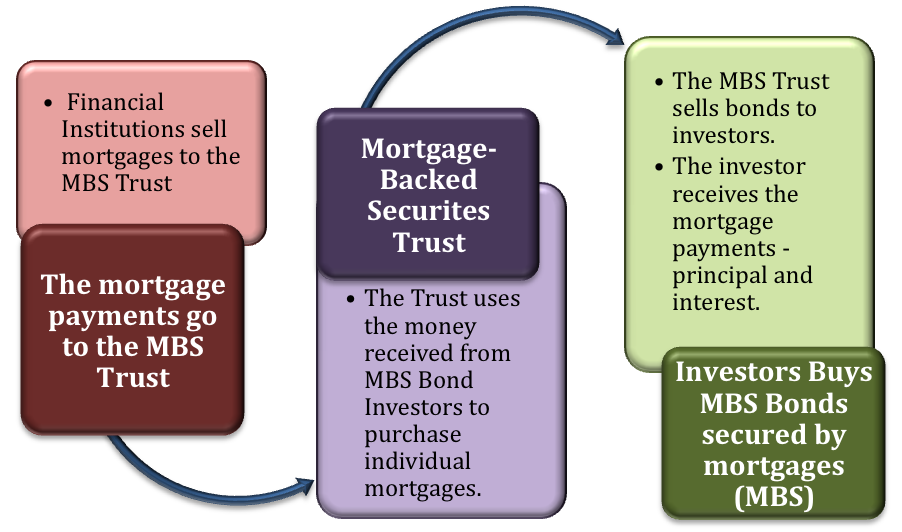

The following diagram outlines the cycle for MBS investments: