Split-Share Capital and Split-Share Preferred Shares

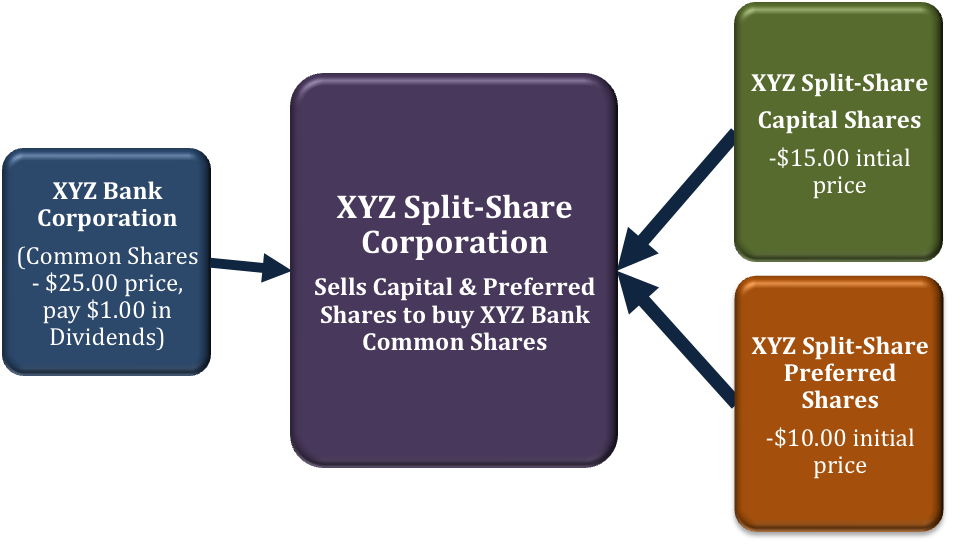

A split share structure is a derivative investment product created by separating a single common share or portfolio of common shares into the following two distinct investments:

- a capital share, which participates in the price appreciation of the underlying asset

- a preferred share, which receives an amount all or a portion of the underlying asset’s dividends and it holds a preferential claim on the net asset value (NAV) of the portfolio of assets.

The division of a single investment (common shares) into two separate investments (common and preferred shares) is accomplished through the formation of a split-share corporation or trust. The corporation will then sell capital and preferred shares to raise capital from investors. The corporation uses the proceeds from the share sales to then buy the common shares of a single or multiple companies.

Example: Let’s assume the following typical structure

- A Split-Share corporation (SSC) is to be set up to raise money from investors and the money raised will be used to buy the common shares of XYZ Bank Corp. -currently trading at a market price of $25.00 and each common share pays a 4.0% dividend, or $1.00, each year.

- The split-share corporation will sell two classes of shares to investors– capital and preferred shares. The SSC will initially sell these shares as a unit and each unit would be purchased for $25.00. Each unit will consist of one capital share, with an initial par value of $15.00, and one preferred share, with an initial par value of $10.00. Once the units are sold to investors, each share (capital and preferred), will trade freely on an organized stock exchange such as the Toronto Stock Exchange.

- The SSC then takes the $25.00 raised by selling Split-Shares and buys the common shares of XYZ Bank Corp.

So, if an investor purchases one unit of the split-share corporation, upon the closing of the initial unit offering, this investor would then hold one capital share and one preferred share.

The split-share corporation would then use the $25.00 received from the sale of the split-share unit to purchase one common share of XYZ Bank Corp.

In our example, the SSC will have two sets of shareholders (a preferred shareholder and a capital shareholder) and one asset ( one common share of XYZ Bank Corp.).

In our simple example above, during the life of the split-share corporation, the SSC preferred shares will receive all dividends paid by XYZ Bank Corp. – $1.00 in dividends for each $10.00 par value share, or 10.0%% annually.

The SSC Capital share will receive no income while it exists. Upon the SSC maturity date, the XYZ Bank Corp. common shares are sold, the SSC preferred shareholder will receive the first $10.00 and the SSC Capital shareholder will receive all, if any, of the residual value above the $10.00.

Note: Typically, the split-share corporation has complete discretion as to how much of the dividends received are actually paid to the holders of the preferred shares. There have been instances where the preferred share’s dividend has been decreased and increased over the life of the split-share corporation.

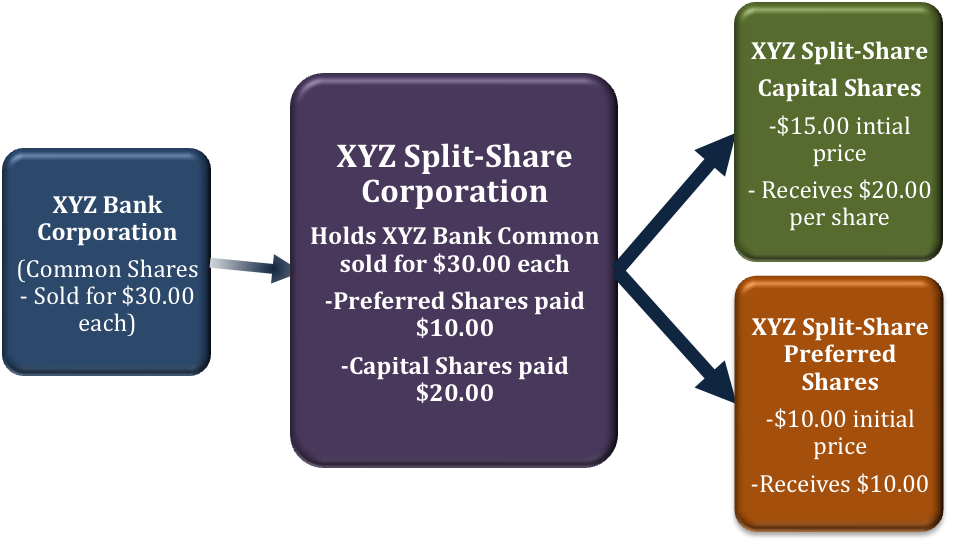

All Split-Share corporations have a limited life span. Typically on a specified date in the future (usually five to seven years) the split-share corporation will sell all of the common shares of XYZ Bank Corp. and it will then distribute the net sales proceeds to the capital and preferred shareholders, with the preferred shareholder having first claim upon the WXZ Bank Corp. sales proceeds. What this means is that the preferred shareholder will be paid their initial investment first (in our example $10.00 per preferred share) and the capital shareholder will receive the remainder of the net sales proceeds.

Note: The termination date may be adjusted if shareholders approve such a change.

Lets continue our example by now assuming the split-share company is to be terminated. If the value of XYZ Bank Corp. common shares have increased from $25.00 to $30.00 per share during the life of the split-shares, then the preferred shareholders will receive their initial $10.00 per preferred share first and the capital shares will receive the balance or $20.00 per capital shares. This would result in the capital shareholders having earned $5.00 for every $15.00 of par value for a 33.33% capital gain, and the preferred shareholders would have received the $1.00 of dividend income each year, or a 10% annual return.

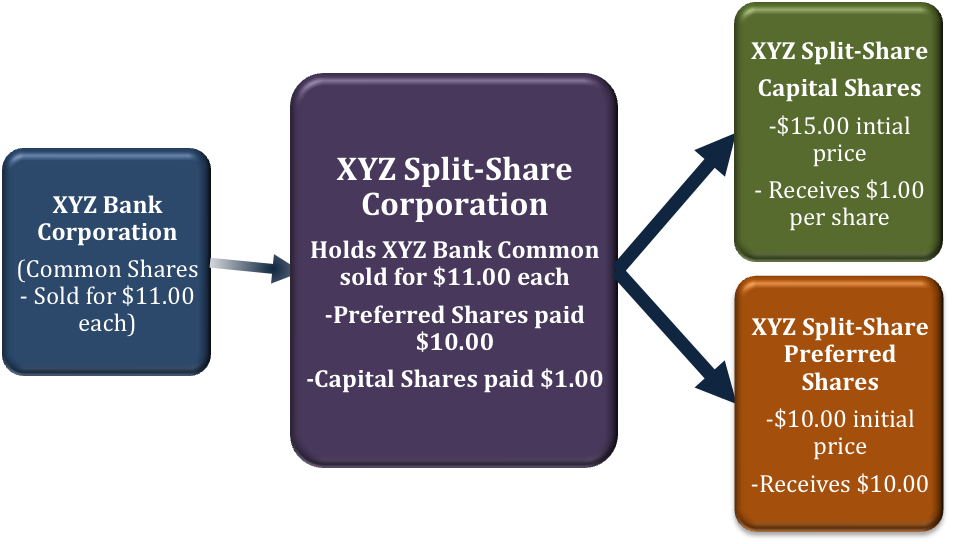

Split-Share structures are not risk free for either capital or preferred shareholders. If the underlying asset’s market value is below the original issue price of the split share corporation’s units, then the preferred shareholders have first claim on the proceeds and the capital shareholder will receive the balance, if any.

In our simple example, if on the termination date the common shares of XYZ Bank Corp. have declined from $25.00 to $11.00, and then if the split-share corporation were wound up, the preferred shareholder would receive the first $10.00. This would leave $1.00 for the capital shareholder, generating a capital loss of $14.00, or 93.3% capital loss.

Note: If the common shares of XYZ Bank Corp are sold for less than $10.00 each, then the capital shareholders would receive nothing and the preferred shareholders would suffer a loss as well.

Main purpose of split-shares

One of the purposes of these split-share corporations is to enable investors to choose the income-tax characteristics of investment distributions. For example, if investors really only want to have capital gains and no income, they can purchase the capital shares. But if the investors only want dividend income with a lower risk of a loss of principal, then they can purchase the preferred shares.

The corporation may be legally structured as a closed-end investment trust or a mutual fund. A closed-end investment trust differs from a mutual fund as follows:

- The trust issues a limited or fixed number of units and the units can only be redeemed or surrendered once a year, where mutual funds are redeemable daily.

- The closed-end units are traded on an established stock exchange (as are common shares), where mutual fund units are bought and sold through the mutual fund company itself.

- The units of a closed-end trust, unlike mutual funds, are not offered on a continuous basis.

- A closed-end trust is permitted to borrow money, whereas mutual funds are not permitted to do so.

For more information click on the FAQ section