Designating a Beneficiary

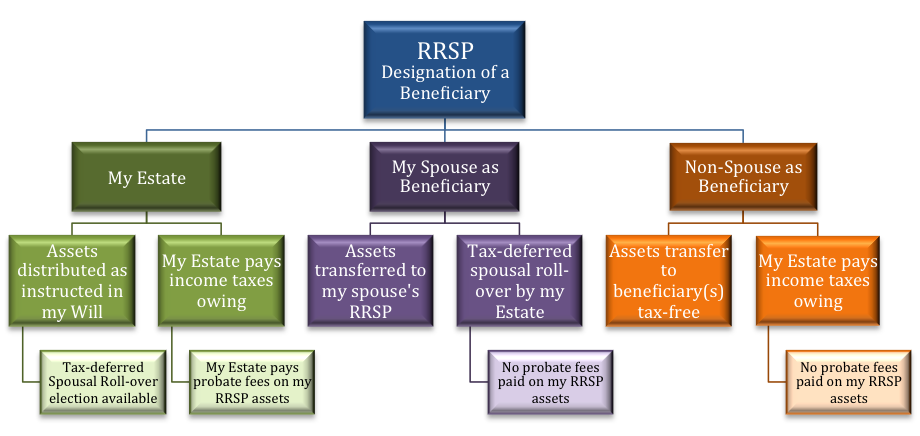

One of the unique benefits of an RRSP account is its ability to designate how your investments are transferred to your beneficiaries upon your death. The RRSP assets can be transferred directly to the beneficiaries you designate (in the RRSP account documentation) bypassing your estate, or the assets can be designated to form part of your estate and distributed according to the instructions contained in your will. Whichever method you select, you should ensure that it is not at odds with your overall estate plan.

What to Consider when Designating a Beneficiary?

When considering your choice of beneficiaries, you should understand that regardless of your designation of a beneficiary, the Canada Revenue Agency (CRA) deems that your RRSP Plan was fully deregistered just before your death. As a result, the full fair market value of your RRSP is considered to be taxable income included in your Date of Death Income Tax Return.

So if you designate a beneficiary other than your estate, the RRSP assets will automatically roll-over or transfer to your beneficiary, but your estate will be responsible for including the RRSP assets as income and pay any resulting income tax.

The following figure illustrates the different possible ways in which you can designate a beneficiary:

Note: Throughout this section our reference to spouse and surviving spouse also includes common-law partner and surviving common-law partner.

If your spouse is designated as the RRSP beneficiary or they are a residual beneficiary of your estate, the value of your RRSP assets are still to be included in your Date of Death Income Tax Return, but your estate’s legal representative will jointly elect to defer taxation from your estate’s hands into your spouse’s hands.

If your estate incurs the income tax liability for your RRSP, your overall estate plan should ensure that your estate retains sufficient assets to pay the income tax owing on your Date of Death Income Tax Return.

Important Tax Note: While it is generally accepted the deceased’s estate is responsible for paying the income taxes that arise from a person’s death, it should be noted that if the estate is insolvent or does hold sufficient assets to pay the estate’s income tax bill, the Canada Revenue Agency (CRA) can require the RRSP’s Designated Beneficiary to use all or a portion of the RRSP’s assets received to pay any outstanding income tax owing by the estate.

The designation of a beneficiary should be considered an estate planning tool to assist in the successful distribution of your estate. The following section outlines the options for designating your beneficiary:

Designating my estate as the beneficiary of my RRSP

By designating your estate as your beneficiary upon your death, your RRSP assets become part of your estate and their distribution is guided by the instructions in your will.

Having your RRSP assets distributed through your estate may be desirable for various estate planning reasons such as the following reasons listed below:

- You have beneficiaries that are minors.

- You have beneficiaries that are physically or mentally dependant and require assistance in managing their finances.

- Your will creates Inter-vivos Trusts that need to be funded with your RRSP assets.

- Your estate will need liquid assets to help pay the income tax owing as a result of your death.

- Your estate will require liquid funds to pay cash bequests you have made through your will.

Note: There may be additional estate planning reasons for designating your estate as the beneficiary of your RRSP.

When you designate your estate as the beneficiary of your RRSP assets, your RRSP investments become an asset within your estate and as such these assets will add to your estate’s Probate Fees payable. Each provincial government publishes a Probate Fee schedule and the fees vary by province.

Even though designating your estate as the beneficiary of your RRSP will cause your estate’s assets and Probate Fees payable to increase, it will not eliminate the spousal rollover benefits available to your estate.

If you designate your estate as the beneficiary of your RRSP and your surviving spouse or common-law partner are residual beneficiaries under the terms of your will, your estate’s legal representative and surviving spouse can make a joint election, using the CRA form T2019, whereby all or a portion of the surviving spouse’s inheritance be in the form of a spousal rollover of your RRSP into the surviving spouse’s registered account. This joint election would have the same affect as a Spousal designation on the deceased’s RRSP. The RRSP assets would remain tax sheltered and simply transfer into the surviving spouse’s registered account.

The CRA does make limited provisions for income tax deferral when a deceased’s estate names financially or mentally dependant children and grand-children as beneficiaries and the deceased’s RRSP investments form part of the deceased’s estate.

Note: The rules governing RRSP rollover provisions for dependant children and grandchildren are extensive and an accounting professional should be consulted before the estate’s legal representative makes such an election.

The financial institution that administers your RRSP will transfer your RRSP assets to your estate and issue a T4RSP (Box 34) Income Tax Information Slip for the dollar value of your RRSP as at the date of death, which your estate’s legal representative will include in your Date of Death Taxable Income. If any RRSP assets are to be rolled-over to a surviving spouse, the estate’s legal representative and surviving spouse will use CRA form T2019 to make a joint election to affect a Rollover to the spouse’s RRSP.

Rollover elections can be a strong estate and income tax planning tool and should be used where they reduce or defer the overall income tax liabilities for the beneficiaries and the estate.

Because your RRSP assets are transferred to your estate, they are included as an asset of your estate, and the Probate Fees payable by your estate will increase.

Designating a person other than my spouse as the beneficiary of my RRSP

When you designate someone other than your spouse as the beneficiary of your RRSP, your RRSP investments will transfer automatically upon your death to that person. Your RRSP investments are withdrawn from your RRSP and transferred into the name of your beneficiary as non-registered investments. Your beneficiary receives and holds the transferred investments in a taxable environment. The RRSP assets cannot be transferred into your beneficiary’s registered account.

Your estate must include the value of your RRSP assets in your Date of Death Income Tax Return and your estate is responsible for any resulting income tax payable.

If your designated beneficiary is a child or grandchild that was dependent on the RRSP annuitant for support due to mental or physical infirmity at the time of their death the RRSP payment to the dependent child or grandchild may qualify as taxable to the beneficiary rather than the deceased and may be eligible for a rollover into a special annuity consisting of equal annual payments until the beneficiary reaches 18 years of age.

Note: The rules governing RRSP rollover provisions for dependant children and grandchildren are extensive and an accounting professional should be consulted before the estate’s legal representative makes such an election.

The financial institution, that administers your RRSP, will transfer your RRSP assets to the designated beneficiary and issue a T4RSP (Box 34) Income Tax Information Slip, for the dollar value of your RRSP, as at the date of death, which your estate’s legal representative will include in your Date of Death Taxable Income.

Because your RRSP assets are withdrawn and transferred directly to your designated beneficiary, they are not included as an asset of your estate and no Probate Fees are paid.

Designating my spouse or common-law partner as the beneficiary of my RRSP

When you designate your spouse as the beneficiary of your RRSP, your spouse has the option to withdraw the RRSP investments and have them transferred into a non-registered, taxable environment or your spouse can elect to transfer your RRSP investments directly into their own registered account.

If your surviving spouse elects to withdraw your RRSP assets and transfer them into a taxable environment, then your spouse will receive the full value of the RRSP investments, your estate will include the RRSP value in the Date of Death Income Tax Return and pay any resulting income tax owing.

If your surviving spouse elects to transfer the RRSP assets directly into their RRSP plan, then your RRSP assets will retain their tax-deferred character by remaining sheltered within your spouse’s registered account.

How the T4RSP Income Tax Information slips are issued will depend upon two CRA conditions being satisfied:

- The surviving spouse is named in the RRSP agreement as the sole beneficiary of the deceased’s RRSP, and

- All of the deceased’s RRSP assets are transferred directly into an RRSP or a RRIF where the surviving spouse is the annuitant, by December 31 of the year following the year of death.

If both of the these conditions are met, then the T4RSP slip will be issued in the name of the surviving spouse, not the deceased’s name. In Box 18 of the T4RSP slip will be the dollar amount of the deceased’s RRSP assets that have been transferred into the spouse’s RRSP. This amount is reported on line 129 of the surviving spouse’s income tax return. In addition, the surviving spouse will receive a contribution slip showing the same dollar amount (as that shown in Box 18 of the T4RSP slip) was contributed to the spouse’s RRSP. The contribution receipt can be used to claim a deduction thereby offsetting the amount included as income on the T4RSP.

If only one or none of the above conditions are satisfied and the surviving spouse is a beneficiary of the RRSP, then the financial institution that administers the deceased’s RRSP will issue a T4RSP Income Tax Information slip, in the deceased’s name, and the amount shown in Box 34 will be the fair market value of your RRSP assets, as at the date of death, and any amounts transferred to your surviving spouse’s RRSP will be shown in Box 18. Your estate’s legal representative will record amounts in Box 34 as income of the deceased and then record the amounts in Box 18 as a deduction from the deceased’s income. In addition, the estate’s legal representative and surviving spouse may need to file a T2019 form identifying the amount transferred to the surviving spouse and included in the spouse’s income tax return. The surviving spouse should also receive a contribution receipt, which can be used as a deduction.

For further information on designating a beneficiary, see the FAQ section.

For more information on RRSPs check out the following pages: